Impacts of Digitization in the Mortgage Industry

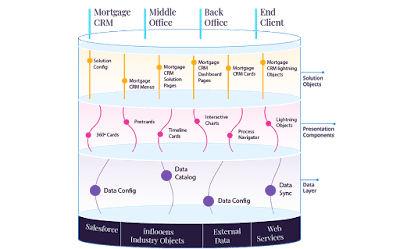

Digitization has the power to transform the financial industry and is becoming a significant segment of successful business tactics. Digital transformation is making a concrete impression in the business operations and providing numerous opportunities for quick, cost-effective, and efficient business solutions. Modern financial institutions have come a long way while embracing digital technologies. The progress of banking institutions can be determined by digital technologies that are causing the mortgage disruption such as Artificial Intelligence, Machine Learning, and Blockchain. Fintech startup inflooens is acknowledging the significance of digitization in the banking sector in the competitive financial market. It has encouraged the production capabilities, improved efficiency, and empowered the staff, to concentrate on fruitful operations. Digitization is giving rise to the disruption in the mortgage industry and enhancing the customer experience by deeply...