How Mortgage CRM is providing solutions to overcome the business challenges?

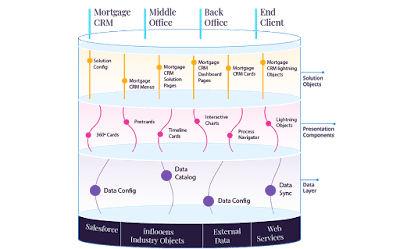

The mortgage industry is demanding effective communication between the customer and the employees, also discerning the need for personalized services by the customer. A wide range of mortgage CRM software is available in the market and all are created with their unique functionalities. It is a significant assessment for the loan officers to choose the best CRM software for their mortgage business and overcome the challenges. Fintech startup inflooens has designed the world’s best “Loan Team Optimization Platform” that is integrated with Salesforce enabled CRM software used in Loan Origination System. Our CRM software is cost-efficient, reliable, and reduces the trammels of the organizations. The software is uniquely designed that can be utilized for marketing, sales management, and business development. Mortgage industries value the relationship between the customer and the business and they continuously strive to strengthen the relationship. This commonly dem...