Top innovations in Financial Services that turned out to be game-changer in the Mortgage Industry

The financial sector is experiencing technological innovations in financial services. The possible reasons are improving the customer experience, integrating technical renovations and modernizing the financial institutions. An increase in customer expectations is causing the banking sector to integrate finance with technology and presenting a new model in finance sector. They are constantly engaged in finding new ways to generate revenue and push the finance industry for development. Fintech expands the approach to financial services through artificial intelligence (AI), cloud computing, big data, and data analytics for operational shift, encouraging digitization for rapid growth, and reliable access to financial services.

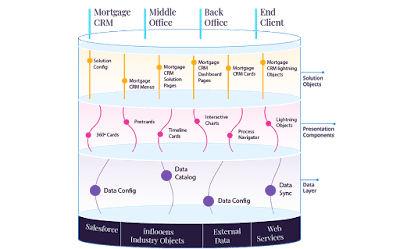

Fintech startup inflooens is the world's first loan team optimization platform that focuses on significant business outcomes. The "Empower Framework" provides a complete 360-degree view of the loan process and is transforming the mortgage lifecycle. The software reduces processing times and improves productivity. inflooens platform enables the financial institutions to become responsive, efficient, dynamic, and transforming the business environments. Designed with the next-generation technologies, the software customizes the business requirements and allow business growth with scalability and enhanced security provided by Salesforce.

Let us check the innovations in financial services that are transforming the mortgage lifecycle:

1. Cybersecurity

Cyber risks are increasing at a rapid rate and causing the customer's data a great threat. Traditional practices of data management are obsolete. The financial industry is observing modern innovation and eliminating the potential provenances of cyber-attacks. Dealing with the organization's data through data handling and real-time monitoring software is the best way to overcome these threats.

2. Instant payments

Customer expectations are evolving dramatically and payment related expectations are rising promptly. Instant payment options are mandatory as online transactions are substituting cash transactions. Therefore, financial institutions should upgrade their services and find reliable ways to serve customers. Banks and other financial institutions are partnering with fintech to prepare a modern services portfolio.

3. Open and modernized banking system

Application Programming Interface (APIs) is paving the way for the expanded and modernized banking system. Banking organizations are providing the customer with more readiness to elaborate their synergies with the financial service providers related to the banking services. API encourages collaboration between banking ecosystems & consumers and allowing them to have better control of their data.

4. AI-driven Support

Financial institutions are incorporating AI-driven technologies such as chatbots for better lending decisions. It is widely employed in back-end operations for better understanding of the customer requirements. risk management, enhancing customer experience and maintaining product delivery. AI combined with ML and cloud computing is also helping in segregating structured and unstructured data in the financial sector.

5. Digital Banking Services

Organizations practicing traditional ways of operations are moving towards digital banking entities. Monetary transactions, lending, and other customer services are performed through digital channels. Banking institutions aim to strengthen the customer experience and safeguard the customer base by recognizing their interests and values.

6. Better access to data

Innovations have empowered customers and lenders to have better access to data to make quick decisions. Customers can easily determine their eligibility for a loan and purchasing any property. Lenders can also check the consumer's financial conditions and their potential for loan eligibility. The platforms track their income and savings status and the application process becomes more secure for them.

7. Risk minimization and customer retention

Adopting new technologies improves security factors in the mortgage industry, therefore risk parameters for both lenders and customers are minimized. Blockchain, AI, ML technologies are developing a secure model in the lending industry. Therefore, customers are becoming more stable and retention power is increased with digitization.

8. Improved operational efficiency

Digitization is dynamic & configurable and is already on the way to eliminate the sheer amount of manual work required in the mortgage industry. Fulfilling the changing demands of customers also enhances the workflow, operational efficiency, and transforming the mortgage lifecycle in the mortgage industry.

Conclusion

Innovations in financial services is laying the foundation for the integration of fifth-generation technologies and providing cybersecurity for customer's private data. The evolution of the financial industry prompts business persons to foresee a significant advantage in implementing modern technologies to advocate modern practices. Fintech startups are partnering with banking institutions to outreach a new customer base.

inflooens is the world's smartest loan origination platform and providing the customers with productivity gain by 30 percent and 10 times faster processing of loans. With modern software, we have acknowledged growth in customer rate by 30 percent over 3 years.

Integrate the inflooens software with your business model and experience creative accuracy and technological innovations.

Comments

Post a Comment